Azerbaijan Witnesses Surge in Consumer and Mortgage Loan Demand in Q1 2023

Consumer and mortgage loans increased in Azerbaijan in the 1st quarter of 2023. In a promising development for Azerbaijan’s economy, the demand for consumer and mortgage loans experienced a notable upswing during the first quarter of 2023. As revealed by the Central Bank’s comprehensive survey on lending activities, various factors contributed to this surge, including optimistic prospects within the real estate market, evolving interest rates, and the ongoing process of digitalisation. The findings of the survey shed light on the borrowing behavior of the population, with a significant percentage of banks reporting an increase in public borrowing levels. Let’s delve deeper into this remarkable trend and explore the implications for Azerbaijan’s financial landscape.

Optimistic Outlook for Real Estate Market Drives Loan Demand

One of the key drivers behind the heightened demand for consumer and mortgage loans in Azerbaijan was the positive outlook within the real estate market. As the survey indicates, the population’s high expectations regarding real estate investments propelled them towards seeking loans to capitalize on potential opportunities. This surge in demand reflects a growing confidence in the stability and growth of the real estate sector, indicating a positive sentiment towards long-term investments.

A Crucial Factor in Loan Demand

The fluctuating interest rates also played a significant role in stimulating the demand for consumer and mortgage loans in Azerbaijan. Amidst a dynamic economic environment, borrowers closely monitor interest rate trends, as they directly impact the cost of borrowing. The survey results revealed that a considerable proportion of the population, motivated by the prospect of favorable interest rates, seized the opportunity to secure loans during the first quarter of 2023. This heightened demand reflects borrowers’ strategic decisions to take advantage of the current financial landscape and optimize their borrowing costs.

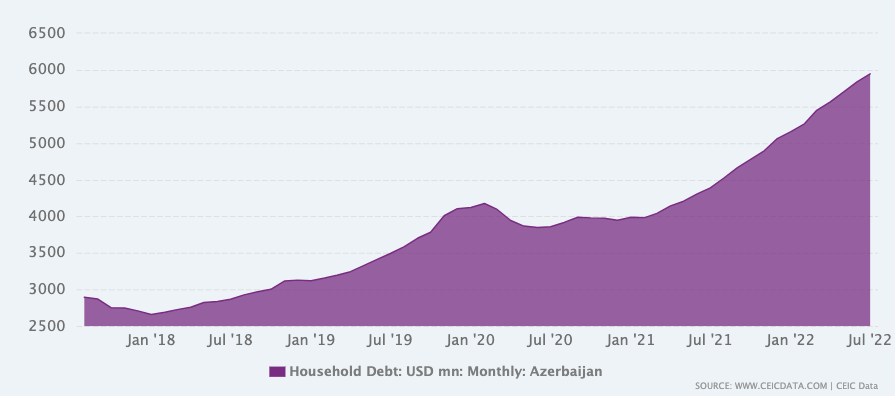

Azerbaijan Household Debt

Household debt in Azerbaijan refers to the total amount of debt held by individuals and families in the country. As of the latest available data in 2022, Azerbaijan’s household debt stood at approximately 55% of its GDP, indicating a significant burden on its citizens. This debt includes various forms, such as mortgages, consumer loans, and credit card debt. The increase in household debt in recent years has been attributed to factors such as easy access to credit, rising living costs, and an increase in consumer spending. The government of Azerbaijan has recognized the importance of managing household debt and has implemented measures to promote responsible borrowing and financial literacy among its citizens to mitigate the risks associated with high debt levels.

Embracing Digitalisation for Enhanced Accessibility

Another noteworthy factor influencing the surge in loan demand is the ongoing digitalisation efforts within Azerbaijan’s financial sector. The survey highlights that the increasing availability and convenience of online banking services have empowered borrowers, making loan applications and transactions more accessible than ever before. The ease and efficiency offered by digital platforms have significantly streamlined the borrowing process, resulting in an overall increase in loan applications during the first quarter. This shift towards digital channels has opened up new avenues for borrowers, encouraging them to leverage the benefits of technological advancements in their financial endeavours.

Analysis of Banks’ Observations

The survey also gathered insights from banks regarding the changes in public borrowing levels during the first quarter of 2023. A notable portion, 42% of banks, reported no significant changes in public borrowing. However, a majority of 54% noted a moderate increase in the level of public borrowing. This increase signifies a growing reliance on loans among the population and underlines their proactive approach towards fulfilling financial needs and aspirations. Conversely, 4% of banks reported a moderate decrease in public borrowing, reflecting a more conservative borrowing behavior among a small subset of the population.

Conclusion

In recent years, Azerbaijan has witnessed a significant rise in consumer and mortgage loans, reflecting increased borrowing by individuals. According to available data, consumer loans have experienced a steady upward trend, with a notable surge in demand. This can be attributed to factors such as expanding access to credit, economic growth, and increased consumer spending. Additionally, mortgage loans have also seen substantial growth, driven by the government’s efforts to promote homeownership and provide affordable housing options to its citizens.

The first quarter of 2023 brought positive news for Azerbaijan’s financial sector, with a surge in consumer and mortgage loan demand. Driven by optimistic real estate market expectations, evolving interest rates, and the embracement of digitalisation, borrowers demonstrated a proactive approach towards capitalising on favorable economic conditions. As public borrowing levels increased, the population showcased their confidence in the stability and growth of Azerbaijan’s economy. This trend highlights the importance of monitoring market dynamics and adapting lending strategies to cater to the evolving needs of borrowers. By leveraging these insights, Azerbaijan’s financial institutions can continue fostering an environment conducive to responsible lending and sustainable economic development.

Also read: